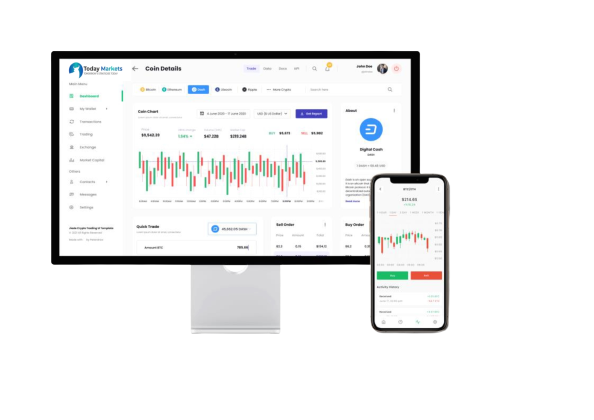

PLATFORMS AND TECHNOLOGY

Today Markets recognizes the importance of having a robust and non-latent technology infrastructure, one that caters to the needs of all institutional FX market participants, from banks and fund managers through to retail brokers and aggregators.

"With a good perspective on history, we can have a better understanding of the past and present, and thus a clear vision of the future." — Carlos Slim Helu

Our platform offerings, and their underlying supporting technology, have been developed with one common goal, to facilitate Direct Market Access (DMA) via GUI, Bridge and/or FIX API.

Full Order eXecution

Anonymous, low-latency access

TRADERS

By delivering anonymous, low-latency access to multi-bank, multi-asset liquidity, Today Markets presents a compelling alternative to the single and multi-bank RFQ and ECN models currently available to institutional traders.

The Today Markets model takes the competitive, multi-bank elements of RFQ platforms and combines them with the low latency transparency and anonymity of ECNs servicing traders seeking consistent, interbank liquidity powered by robust, real-time market data.

Recent refinements, such as the Full Order eXecution block order trading mechanism, are gaining the attention of hedge funds, asset managers, commodity trading advisors (CTAs) and corporate treasuries.

The Today Markets model takes the competitive, multi-bank elements of RFQ platforms and combines them with the low latency transparency and anonymity of ECNs servicing traders seeking consistent, interbank liquidity powered by robust, real-time market data.

Recent refinements, such as the Full Order eXecution block order trading mechanism, are gaining the attention of hedge funds, asset managers, commodity trading advisors (CTAs) and corporate treasuries.

BROKERS

Today Markets is a wholesale provider of liquidity, technology and credit solutions to brokers who offer FX, Metals, Energies and CFD trading to their clients.

Currently, the firm’s solutions power leading brokers throughout the Americas, Europe, Asia, Australia and New Zealand. Select your category below to learn how Advanced Markets can help you grow your business.

Currently, the firm’s solutions power leading brokers throughout the Americas, Europe, Asia, Australia and New Zealand. Select your category below to learn how Advanced Markets can help you grow your business.